Finance Guru Speaks:

This article will provide details on how you can link your Aadhaar No.

with

HDFC Bank using Internet Banking.

Below are the steps to link your Aadhaar with HDFC Bank Savings Account:-

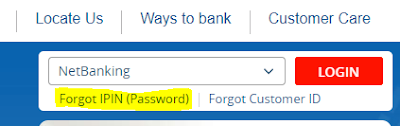

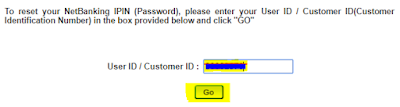

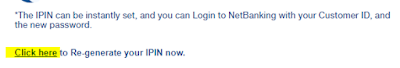

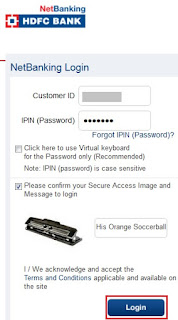

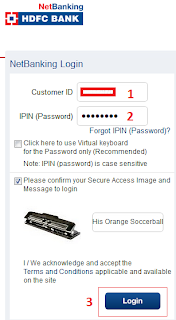

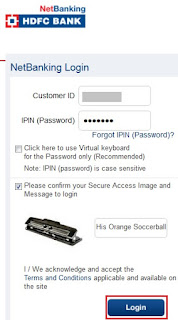

1. Login to HDFC NetBanking Account with your Username/Password.

|

| HDFC NetBanking Login |

2. In the Home page, click on

Request -> View / Update Aadhar Number link as shown below :-

|

| Link Aadhaar Number to HDFC Bank |

Now, provide your

correct Aadhaar Number in the next page.

Congratulations!! You have linked your Aadhaar with your HDFC Savings Bank Account.

Please note :-

- Aadhaar number can be updated with Saving account only. You can link your Aadhaar number only.

-

On submitting, your request for seeding Aadhaar

Number into your account with the Bank will be processed, basis the

validation with NPCI / requisite authorities.

- This request will not be processed, if details in Bank Account do not match with details available with UIDAI.

- The Bank is not responsible for any erroneous updation of Aadhaar Number in your account.

-

If your Aadhaar number is already seeded in your account with HDFC Bank and you wish to change the account, please visit the

nearest HDFC Branch with your Aadhaar Card.

-

Please do not submit parallel requests for Aadhaar seeding using more

than one medium. If you have already submitted your request for Aadhaar

Card linking either with Aadhaar linking form at bank branch / SMS

Banking / Netbanking, please wait for the failure message before again

submitting your request through any of these mediums.

Also Read:

Images Courtesy: HDFC Bank

Please share this article over social networks. For more Learning, Please visit "At A Glance" Section.